The Sobering Reality Behind A "Soft-Landing"

Look around you, all you see is turmoil, confusion, and cope.

Everyone is willingly deluding themselves into believing that everything around them is perfectly fine and within a few years the US will go back to being self-anointed leader of the free world.

I promise you, "delulu" could be the solution for almost everything but basic economics.

We are sitting on the largest and broadest asset bubble of all-time, recklessly propped up over 15 years.

Ideally, it should’ve ended in 2020, but the pandemic coupled with an infinite money glitch both accelerated the crash and made it seem like there was as instant recovery, followed by all-time highs.

We went from 1929 to 1999 within a week.

Everyone became the next Warren Buffet. Everyone became a crypto millionaire.

And the roaring 2020’s had officially begun.

Tesla, the world’s most shorted company, 6xed, split it’s stock, and ended up 10xing.

Free money bought America Louis Vuitton, and ended insecurity for 3 months.

The market was a 130% up, and memecoins were up more than 10,000%.

The US spent $5 trillion over the two years, 60% of which was via deficit financing

Additionally, until the end of 2021, they kept rates at zero and bought $100 billion in bonds every month.

America led itself and the global economy into the most messy financial spectacle anyone has studied, let alone lived through.

And when they realised shit had hit the proverbial fan, they went on damage-control overdrive.

The US had the fastest rate-hike in the history of humanity.

Let me explain it to you in a manner that every college student has probably experienced.

Rate-hikes are like edibles. You think having 4 is chill until you’re 2 hours in.

And then you’re fucked.

Ask anybody in the markets. The markets are almost at an all-time high.

And nobody knows why.

Everyone who has taken a 2 credit Econ class knows that rates are sticky.

Zoom out.

Every island of relevancy in the American economy is quite literally ass-fucked.

Let's start with THE industry that caused a stir in the markets earlier, but hasn’t even begun disintegrating yet.

The housing market.

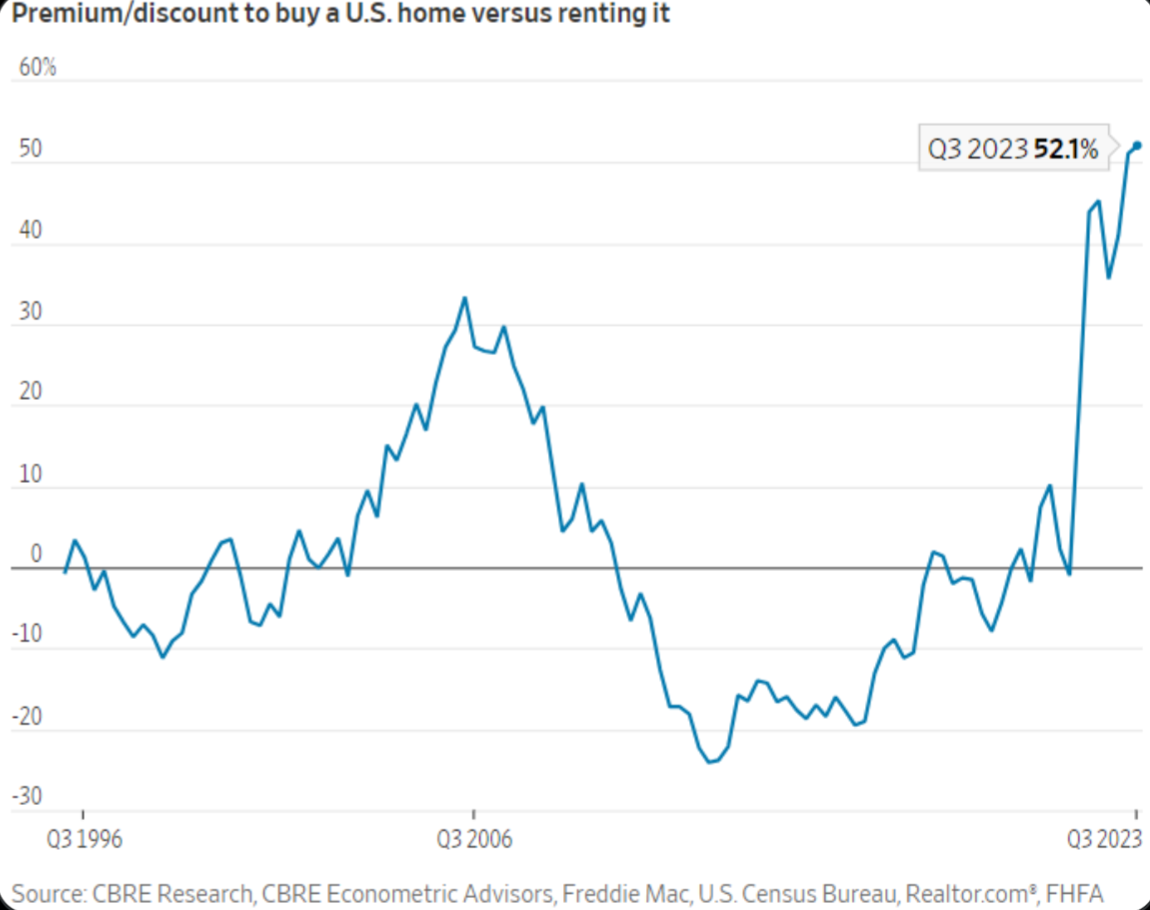

Buying a home is now 52% more expensive than renting, the highest premium on record (note: the premium peaked at 33% during the last housing bubble in 2006).

Meanwhile, the monthly payment on a new mortgage has DOUBLED since January 2021.

In 2021, the median new mortgage payment was ~$1,500/month.

It's now at a record $3,000/month and still rising as mortgage rates hit 8%.

Home foreclosures are up 34% year over year.

This is the most unaffordable housing market since 1989.

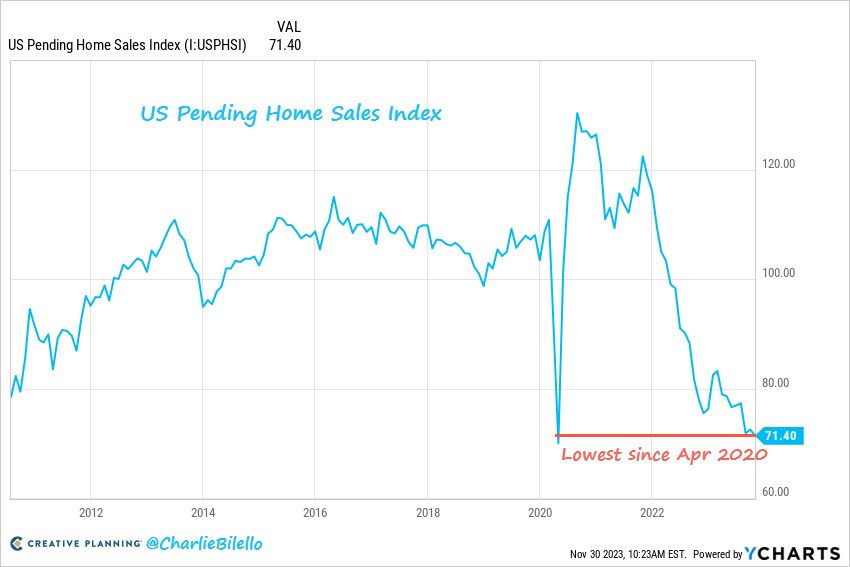

Pending home sales in the US have moved down to their lowest level since April 2020, a month where much of US economy was shut down. The housing market is frozen.

The US market, dominated by 30-year mortgages, is effectively frozen as homeowners with low rates are reluctant to sell and buyers are squeezed

A record ~40% of all US homes currently don't have mortgages.

While this seems like great news, it really just emphasizes how unaffordable this market is.

Currently, a record ~35% of housing market transactions are all cash purchases.

In other words, this market is becoming only affordable for those who are buying with cash.

As interest rates hit 20-year highs and home prices are up 30%+ since 2020, affordability is only getting worse.

US pending home sales fell 1.5% in October, marking the 23rd consecutive monthly decline in pending home sales.

Home price to median income ratio has just hit 7.4X.

To put this into perspective, the metric reached a peak of just over 6.75X before the Financial Crisis.

Current levels are the highest since 1975.

Fewer home sales in the US mean fewer Americans are moving into houses that need to be outfitted with furniture and appliances.

And this isn’t even the part of the housing market that borrowed trillions at ridiculous rates in 2021.

The part that actually about up the regional bank crash.

Small banks currently hold ~70% of all CRE loans in the US, $1.5 trillion of which need to be refinanced by 2025.

US banks hold ~$3 tn in CRE loans on their books. Many of them have over-extended.

~700 US banks have surpassed the 2006 CRE loan concentration guidance.

This means these banks loan book's consist of CRE loans making up 300% of risk-based capital and 36-month CRE growth >= 50%.

These are the same banks that nearly collapsed in the regional bank crisis.

$2.5 trillion in CRE loans to be refinanced at higher rates in the next five years.

$1.5 trillion in CRE loans is due

Occupancy already at record lows, and work-from-home only makes it worse.

Most won’t roll over and could cause valuations to drop 40%.

It’s a Ludicrious La-La Land.

The icing on the cake?

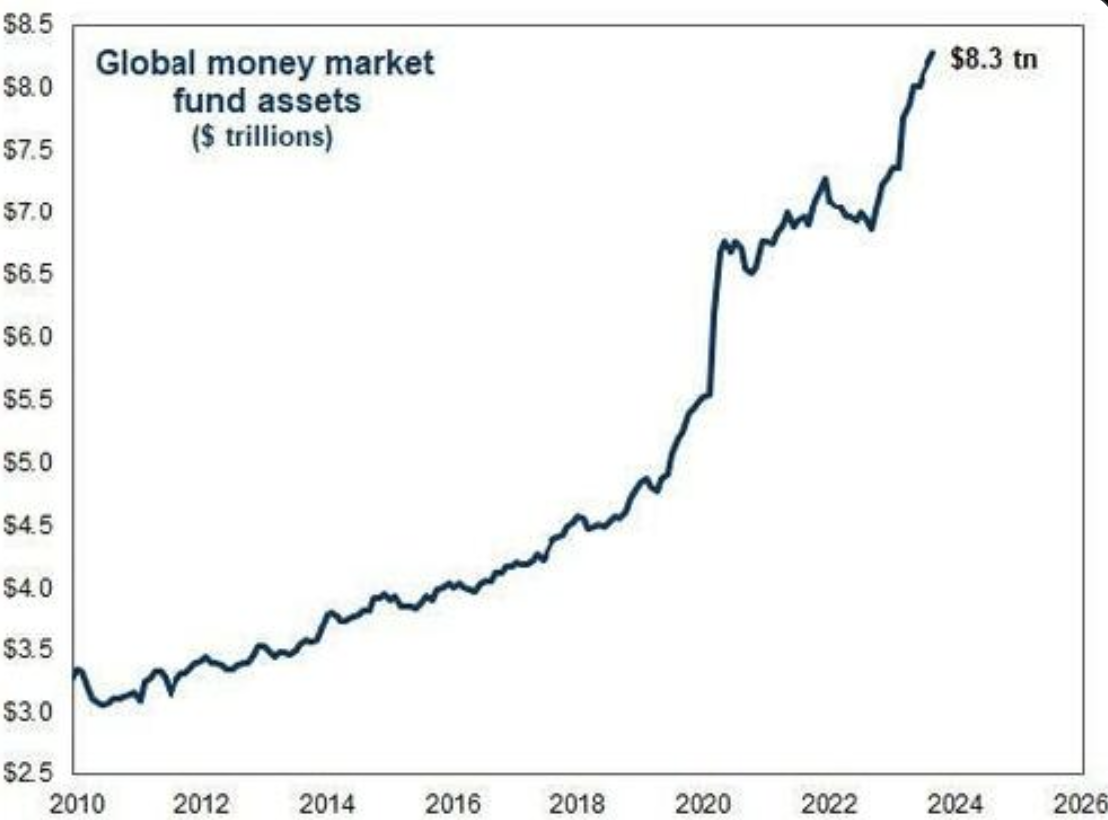

Money-market fund assets are at all-time highs, implying record low cash in banks, just in time for the rest of the CRE Loans to come through.

Ok, bet, half of the people kind-of knew housing is doomed.

Nothing they haven't dealt with before.

The growing industries should pull through, right(?)

Let’s look at the other historical recessionary indicators, starting with transportation.

Orders for commercial planes sank 16% in August.

The rising auto-loan defaults are at an all-time high since 2008.

There are more than double Fiat dealerships in America (359) than Fiats sold (145) in all of Q3.

On the business side overall, US factory orders have plunged 3.6%.

Core factory orders were down for the 8th month in a row in annual declines.

Durable goods (another historical indicator) has plunged 5.4%, and the only reason it didn’t plummet further is because of the massive defense spending done to send Ukraine ammo.

Defense Spending was up 24.7%, and non-defense spending dropped about 15%.

Business inventory is nearing contraction levels.

Storing inventory is too expensive when demands are so low, plus the cost of inventory on a line of credit is too much risk

Inventory contraction often precedes economic downturns, and the last three times this happened was the Dot Com bubble, the Financial Crisis, and the Pandemic.

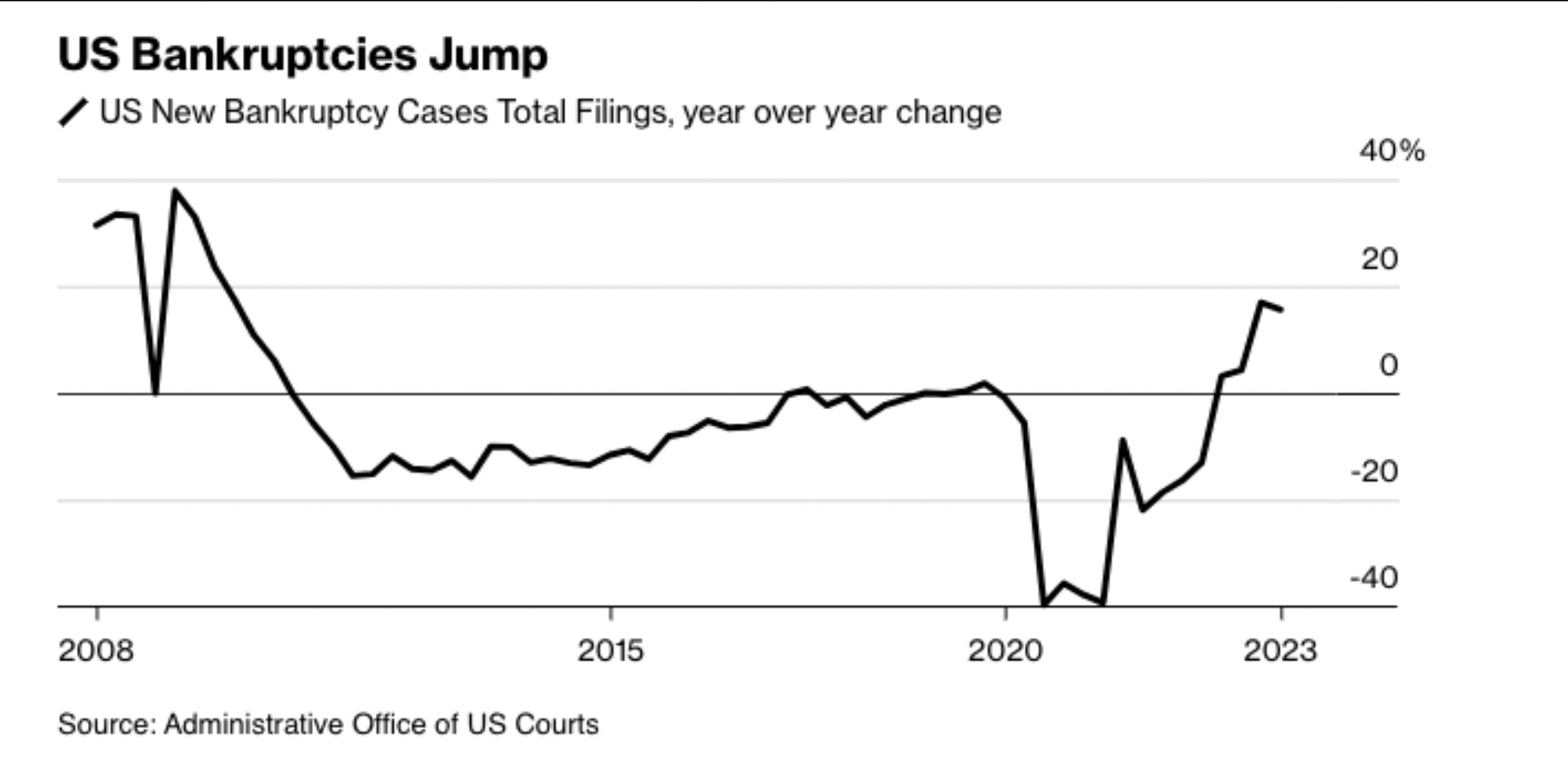

We are seeing the highest level of $10M+ companies filing bankruptcy since 2008.

Recent data from Epiq Bankruptcy, a firm specializing in bankruptcy data analytics, reveals that Americans filed over 39,000 bankruptcy cases last month, marking an 18% increase compared to the same period the previous year.

Remarkably, this marks the 13th consecutive month in which bankruptcy cases have demonstrated a year-over-year increase.

During the pandemic, bankruptcy cases surprisinly experienced a notable decline due to cheap credit and loan extensions.

Gregg Morin, VP of Business Development and Revenue at Epiq Bankruptcy, noted that the sustained year-over-year uptick since suggests that the anticipated growth in bankruptcy filings is materializing.

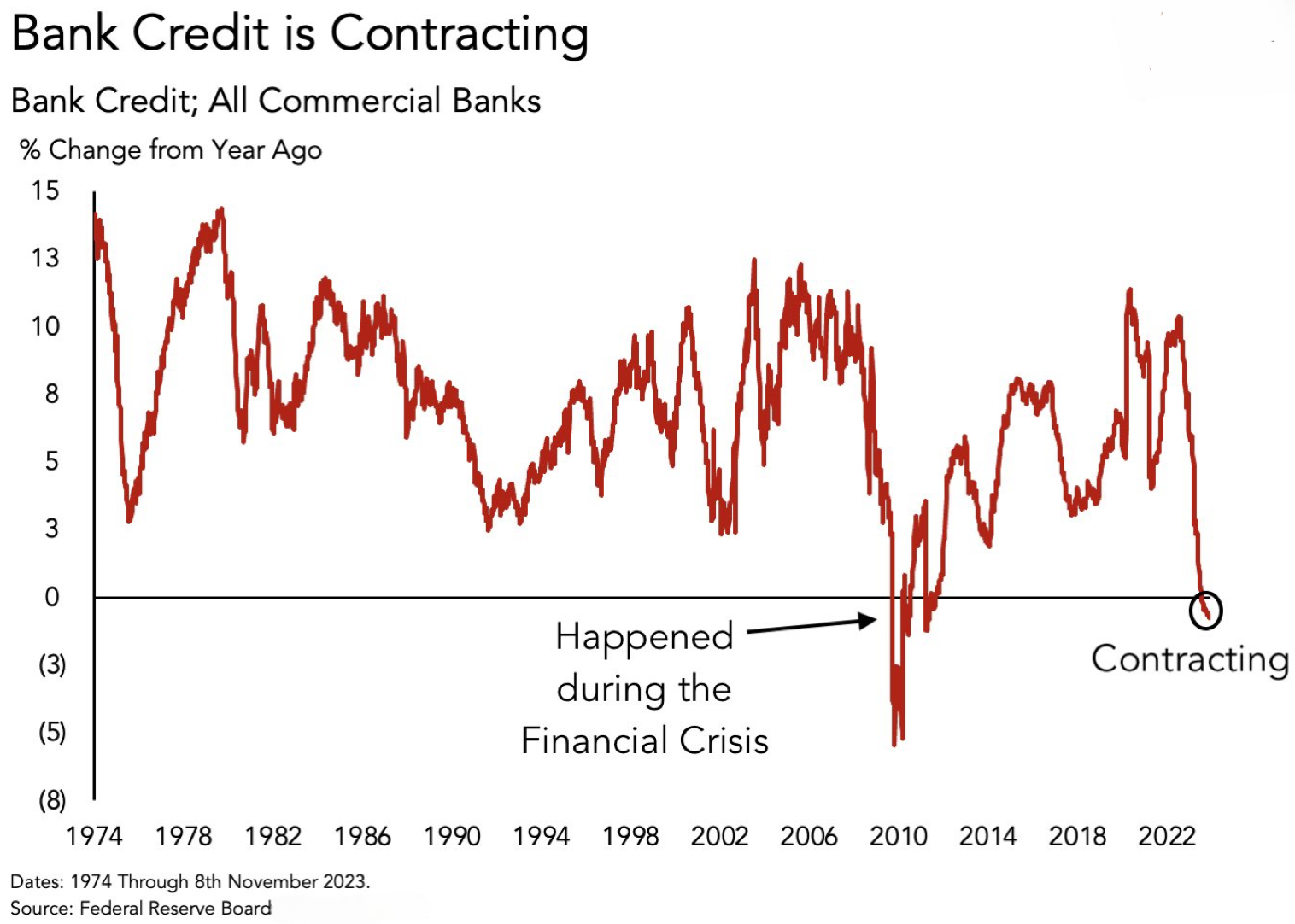

Just look at the rate at which bank credit has been contracting in the past few months.

Ok.

Fine.

Industries are fucked, but surely we can't bet against the unabashed retardation of the American consumer.

How are the homies doing?

Improvising? Adapting? Overcoming?

Better.

Amidst glorious ceremony, we rise as a different animal while staying the same beast.

In fact, Bloomberg has named our new breed of retardation the “YOLO consumer”.

People who prefer spending on "experiences over goods."

In other words, people who skip dinner for months to attend a Taylor Swift concert.

The number of people taking a foreign vacation in America is at an all-time high along with the credit card debt those vacations are taken on.

More than 50% of all vacations are being taken on credit.

The average credit card interest rate has currently risen to 27.81%.

On the other hand, credit card debt has crossed $1 trillion, the highest level ever.

And personal interest payments have surpassed $500 billion

Wake up.

We are witnessing the most retarded version of “Animal Spirits” any civilisation has experienced yet.

“YOLO Consumers” high on “FOMO”

I wish there was a less cringe way of describing it, but there really isn’t.

These fools are not just gambling with stocks or assets, they’re gambling with their livelihood.

People are living like there’s no tomorrow but forgetting that their whole life exists after.

80% of American households are in a worse financial position now than they were before the covid pandemic hit, most not even able to muster up $2000 for an ad-hoc expense.

More than 50% of US consumers made less than $41,000 in 2022.

Excess savings in the US peaked in August 2021 at $2.1 trillion.

Today, it’s down to just $148 billion.

Hardship withdrawal for 401k is hastily picking up pace and an all-time high in the near future wouldn’t surprise a soul.

And yet, there is no stopping the reckless abandon with which Americans are spending.

On Black Friday, sales at brick-and-mortar stores were up 1.1% from last year.

Online alone, US Black Friday shoppers spent a record $9.8bn. They then went on to spent another $12.4bn on Cyber Monday – an eye-popping 9.6% increase over last year. This holiday splurge follows a pattern of US consumer spending, which has buoyed the American economy in the past year, accounting nearly 70% of the real GDP's Q3 growth.

So how exactly are people “affording” to spend like there’s no tommorow?

A magical tool that is often cited as one of the precursors to the Great Depression, popularized during the Roaring 20s.

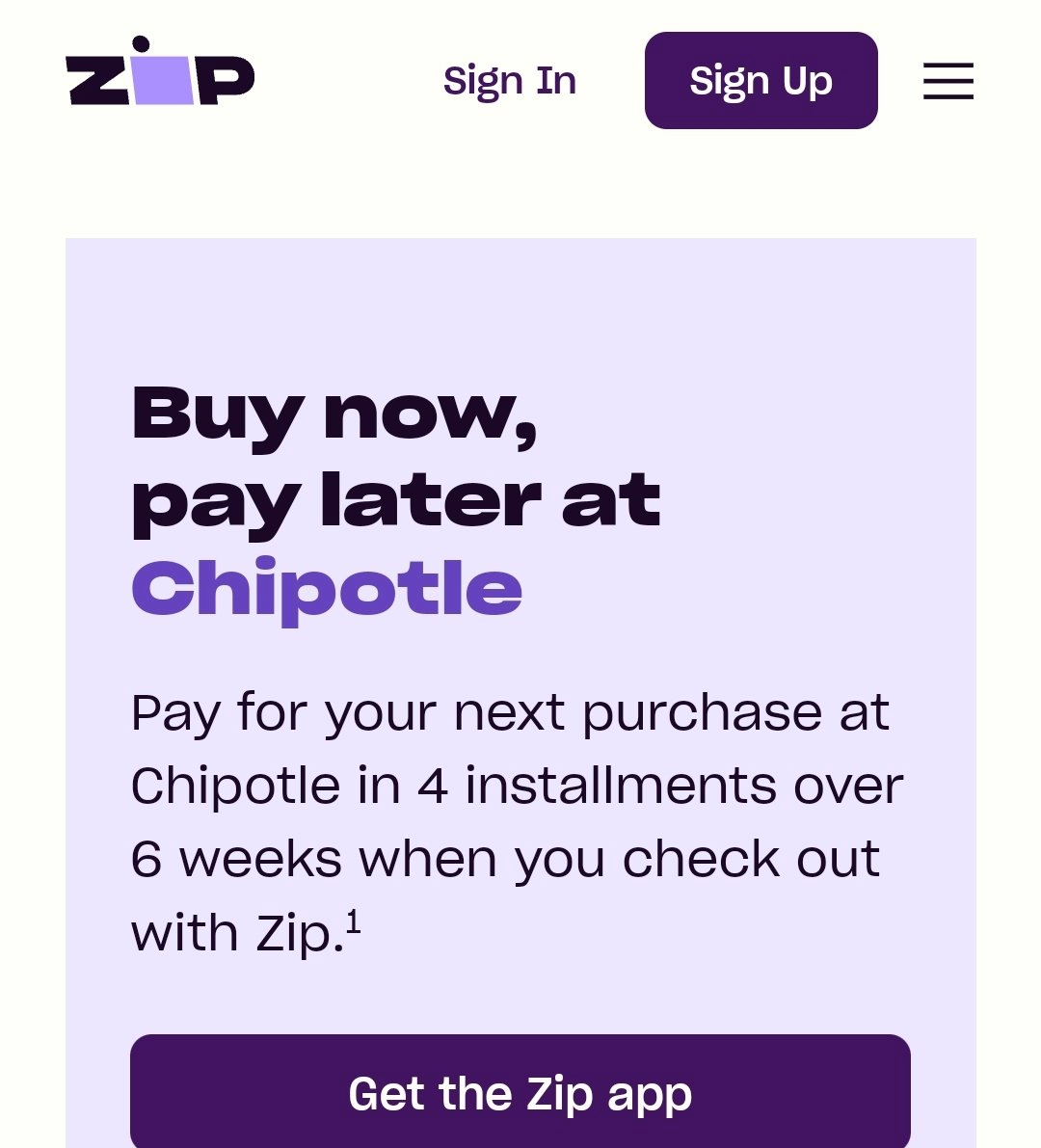

Buy now, pay later.

From luxury goods to concert tickets, Gen-Z is choosing “BNPL” most of their expenditure.

How far exactly are they taking it?

Imagine needing to pay for a burrito in $2.5 installments.

Straits Research values the total BNPL market at $132 billion right now, and expects it to grow to $3.7 trillion by 2030, expecting to record a CAGR between 20% and 45%.

As of last year, 360 million people around the world used BNPL, a number that could almost triple to 900 million by 2027, according to Juniper Research, with use among Gen-Z expected to rise by 50% by 2025.

At $182 billion in the U.S., the credit card market is just $50 billion larger than the total BNPL market, and it accounts for 30% of all BNPL activity.

Adobe reported a 42% increase in BNPL purchases compared to last year. And Afterpay, a BNPL provider, found a similar figure.

As expected, lawmakers are looking into regulating this phenemonon.

LendingTree estimates that 42% of BNPL users have missed a payment. Missing a payment means paying late fees or high interest rates on a payment. On top of that, many BNPL platforms will only report missed payments to credit bureaus.

While BNPL is still on the rise, the risks to consumers are real and regulation could potentially shake up this growing sector.

Only 2% of the people who have migrated to New York over the last 4 years have applied for a work permit.

America is waiting for war so it can capitalise on it’s debt ceiling removal and turn into Weimar 2.0.

That’s what they’ll have to do in order to stay afloat and try to get out of the financial time bomb that is their financial system.

The US went from 22 trillion dollars in July ’19 to 33 trillion dollars in July ’23.

To contextualise the rate of money printing acceleration, from 1990 to 2010 they printed $11 trillion ($2 to $13 trillion).

With debt/GDP at 120%+ and deficit/GDP at ~8% (which goes to 14-16% in a recession), all with tax receipts falling off a cliff, the current fiscal picture is beyond fragile.

Even though the lay-offs and hiring freezes have been slowly creeping from a year, the full brunt of it will only come when there are high prices and companies will start firing people.

Even if the dire economic conditions didn’t exist, with the advent of AGI within a couple of years, things are mostly joever for most of the working population.

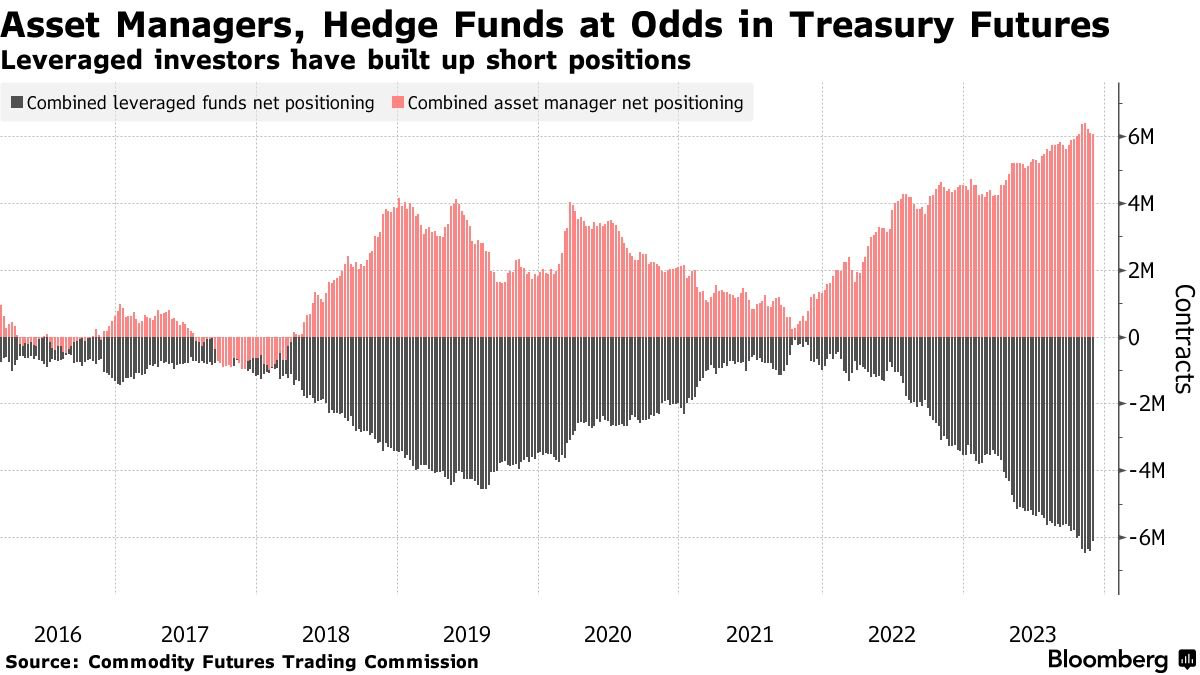

Conventionally, treasuries are used to hedge credit spreads and volatility

But for the first time in 40 years they are more volatile than gold.

Why?

Speculator's net short bets on 2 year treasuries have risen to a record high.

Even the bank of England is petrified of the huge bets on both the short and long side on treasuries.

Unrealized losses on long dated treasuries are crushing the banks because of the rapid rise in short dated treasuries.

China’s already started dumping treasuries, and eventually all emerging markets will begin because all of them are having liquidity problems.

Treasuries are fucked when the Fed pivots.

There is no where to hide except in gold, land and fine art, i.e. commodities.

And yet, every idiot is over the top bullish calling for new highs in the top of a massive double BEAR expanded flat - with $VIX in the 12's.

Literal retardation.

bUt ThE uNeMpLoyMent rAtEs aRe lOw…

Read a fucking book.

The US unemployment rate in April 1929 was 0.7%.

It has ALWAYS cycled lows before a recession.

The green flags you cope with are the red flags that will destroy you.

Overemployment by an anxious population is masking the unemployment numbers.

The US National debt has been growing faster than GDP for the last 10 years.

And now, its growing by the highest margin in history.

Earnings don’t move markets, liquidity does.

The consumers are experiencing shrinkflation and the economy is experiencing stagflation.

The aging population problem of the US is going to cause an inevitable increase of spending on social security (estimated by Druckenmiller to go up to 70% of taxpayer money needing to be spent by 2040), and flooding the economy with deficit financing is only making this worse.

The only realistic choice they have to somehow counter this is to increase both taxes and retirement age.

The US has no choice whichever way they go.

If they stop printing money, the crash will come soon, and they don’t know if they could recover from it.

The other choice is to keep printing money discretely while distracting the populus and then eventually when they are directly involved in way, they can go all out and offciially turn into Weimar 2.0.

In my opinion, the odds that they keep rates high and stop printing money is less than zero because they would never risk losing the election by bringing in the crash before voting.

America’s game theory matrix is a lose-lose.

DO NOT short the economy, irrespective of how certain you are.

More money is lost in predicting a crash than within the actual crash.

Look for great companies and industries that you know are grossly overvalued, and start picking it up when you see clear chinks in the armor.

You cannot afford to get greedy, fearful, or fearless.

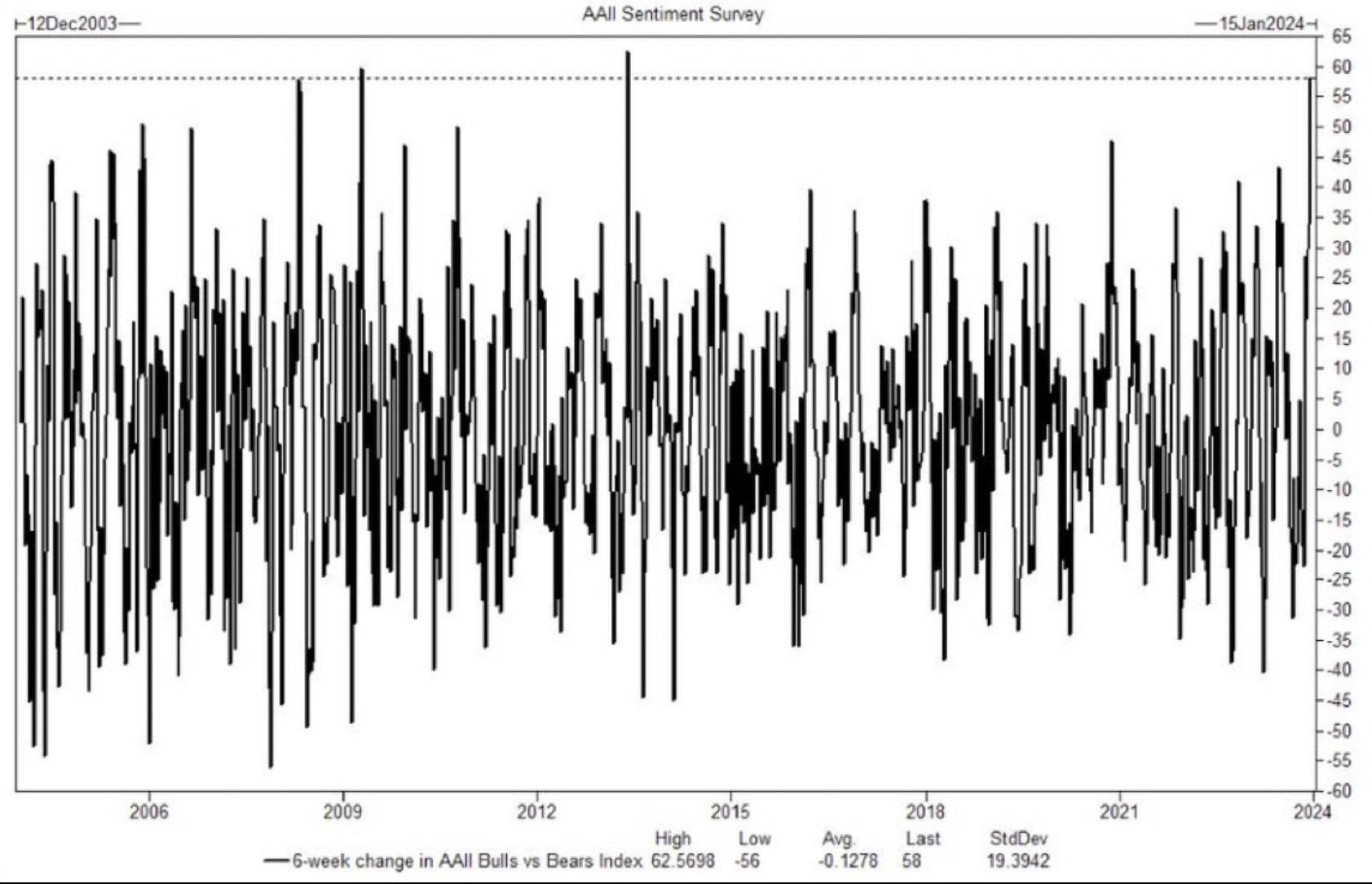

Just look at consumer sentiment.

The shift from bearish sentiment to bullish sentiment over the last 6 weeks is one of the highest ever.

Nobody knows when or why the market moves. Everyone's just impatient with cash waiting to place big bets, so when they get a small chance, they pump up the market further.

A lot of people already have considerable buyers and sellers remorse because of the consistent swinging the market, everyone is either anxiously waiting to start going on a buying spree, or they bought at 2021 unrealistic levels and are waiting to cover their losses.

When people have the sobering realisation that the American economy will crash irrespective, it will be a failed bull run.

The market will supposedly bottom, and most people will invest because Buffet told them to double down when there’s fear.

We tend to forget that apps like Robinhood didn't exist in previous crashes and therefore it took time to hit bottoms as people couldn’t get through to their fleeting brokers.

In this scenario, nobody knows.

The crash could occur in minutes.

People will start buying, but the sell-off caused by the overall liquidity crunch and the the bankruptcies will make the prices keep going lower.

The Fed’s economic policy is chopped.

The only real weapon left in their arsenal is global gaslighting, and they have been constantly spamming random buttons and hoping it fixes things.

Meanwhile, America counts on its dutiful citizens to continue debating multiple wars they’re not involved in, “How many genders are there”, and who Jada fucked today, while they covertly indulge in the very activity that caused everything to be unaffordable.

True story.